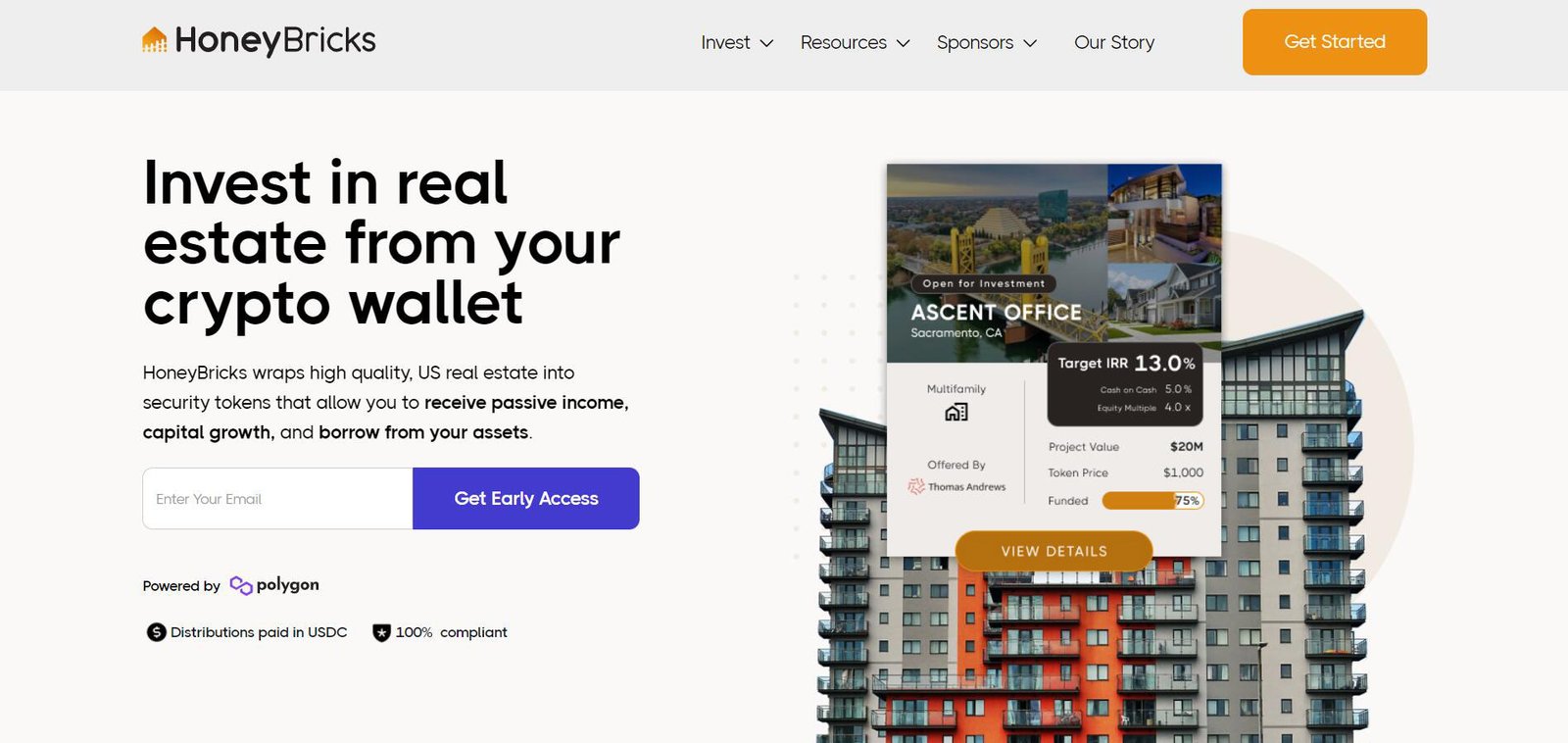

HoneyBricks is a real estate investment platform that allows investors to buy fractional shares of multifamily properties. This can be a great way to get started in real estate investing, as it allows you to invest in institutional-quality properties with lower minimum investment amounts.

However, with so many different investments available on HoneyBricks, it can be difficult to know which one is right for you. Here are some factors to consider when choosing a HoneyBricks investment:

Your investment goals

What are your investment goals? Are you looking for short-term capital gains, long-term growth, or a combination of both? The type of HoneyBricks investment you choose will depend on your investment goals.

Your risk tolerance

How much risk are you comfortable with? Real estate investing is inherently risky, but there are different levels of risk associated with different types of investments. For example, investments in newer properties with higher occupancy rates tend to be less risky than investments in older properties with lower occupancy rates.

Your investment horizon

How long do you plan to hold the investment? Some HoneyBricks investments have shorter hold periods, while others have longer hold periods. If you’re not sure how long you’ll want to hold the investment, it’s best to choose one with a shorter hold period.

The property’s location

Where is the property located? The location of the property can have a big impact on its value and potential for appreciation. It’s important to choose a property in a strong market with high demand for rental housing.

The property’s amenities

What amenities does the property offer? Amenities can add value to a property and make it more attractive to tenants. Some popular amenities include pools, gyms, and laundry facilities.

The property’s management team

Who is managing the property? The property’s management team is responsible for day-to-day operations, so it’s important to choose a team with a good track record.

The property’s financials

What are the property’s financials? It’s important to understand the property’s financial performance before you invest. This includes factors such as occupancy rates, rent collection rates, and expenses.

The property’s valuation

What is the property’s valuation? The property’s valuation is important to understand, as it will determine your potential return on investment.

The HoneyBricks fees

What are the HoneyBricks fees? HoneyBricks charges a management fee and an asset management fee. It’s important to factor these fees into your calculations when you’re considering an investment.

The HoneyBricks liquidity

How liquid is the investment? HoneyBricks investments are not as liquid as traditional stocks or bonds. This means that it may be difficult to sell the investment quickly if you need to.

Your overall investment portfolio

How does the HoneyBricks investment fit into your overall investment portfolio? It’s important to diversify your portfolio by investing in different asset classes. HoneyBricks investments can be a good way to diversify your portfolio and add real estate exposure.

Conclusion

Choosing the right HoneyBricks investment can be a daunting task, but it’s important to do your research and consider all of the factors involved. By following the tips in this article, you’ll be well on your way to choosing the right investment for you.